Advertorial

BUSINESS NEWS - As the impact of geopolitical tensions and the tariff strategy of US Donald Trump gained momentum, markets everywhere dropped sharply in April.

The S&P500 lost around 10% in just days. Then, almost as fast, the market turned.

A 90-day pause triggered a rally and by July, the S&P500 was setting new all-time highs.

Which means investors who panicked during the market drop and sold their investments missed out on the recovery – and higher returns.

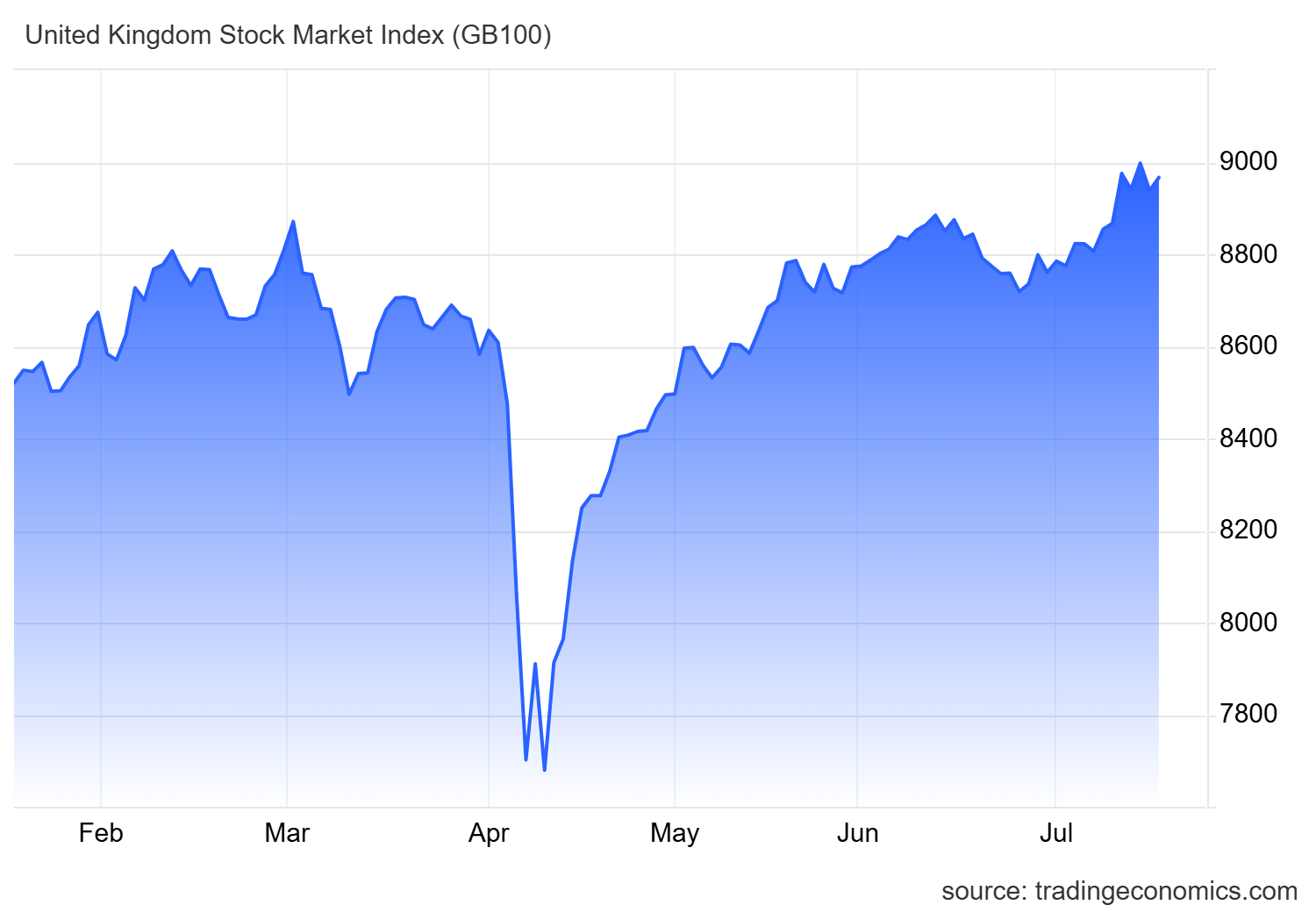

These graphs show that April’s sell-off and rebound was global as the shock announcement stoked fear and uncertainty.

S&P500 index – first 6 months of 2025.

S&P500 index – first 6 months of 2025.

FTSE 100 index – first 6 months of 2025.

FTSE 100 index – first 6 months of 2025.

JSE Alsi index – first 6 months of 2025

JSE Alsi index – first 6 months of 2025

Anyone who tried to time the market – selling during the panic and waiting for things to “settle” – would have missed the rebound. And that mistake can be costly.

The real risk of missing out

Let’s go beyond theory. What actually happens when you try to avoid downturns, but end up missing the best days in the market? A powerful study looked at 5 680 trading days in SA equity market using the Capped SWIX, spliced with the ALSI data, over 20 years of daily returns.

It compared what your returns would have been if you simply stayed invested – versus what happened if you missed just a few of the best-performing days.

The results are striking:

- An investor who stayed invested earned an annualised return of 16.38%.

- Someone who missed the best 30 days earned only 14.58% per year.

That 1.8% difference might not sound like much – but over 20 years, it’s massive.

If you invested R100 and earned 16.38% per annum, you’d end up with R2 077.62 – more than 20 times your original investment. But if you missed those key 30 days and earned only 14.58%, you’d have just R1 521.17. That’s a 27% lower return – despite missing only 0.5% of all trading days.

It’s understandable to feel anxious during market swings, especially when politics and policy seem to drive volatility. But the most important decision you can make is to stick to your plan.

Review your goals. Revisit your time horizon. Speak to your advisor if needed. But don’t let short-term fear dictate a long-term financial strategy.

The biggest risk most investors face isn’t the next crash. It’s missing the next recovery.

Ruan Breed is a financial advisor at Brenthurst Wealth George and Stellenbosch

ruan@brenthurstwealth.co.za

‘We bring you the latest Garden Route, Hessequa, Karoo news’