OPINION - The JSE has undergone a notable transformation over the past two decades, marked by a significant reduction in the number of listed companies.

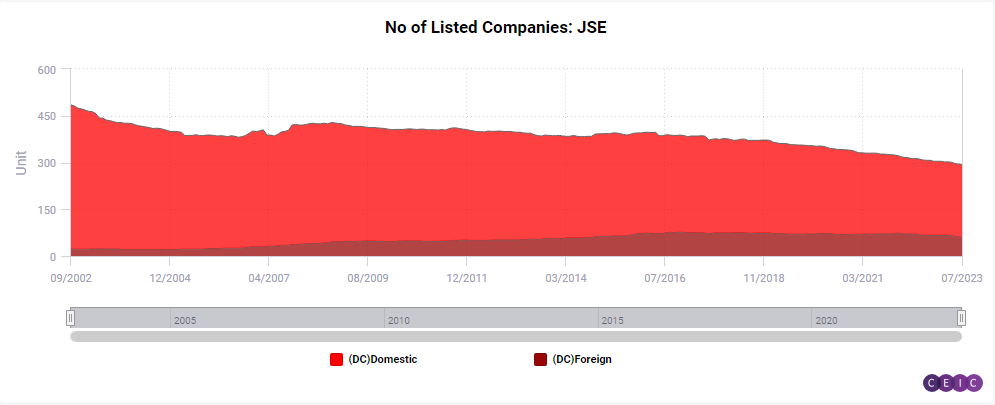

From its peak of 484 listed companies in 2002, the JSE has seen a decline to 302 as of Q1 2023, representing a 38% decrease.

While these changes may raise concerns among investors, it's essential to examine the underlying factors driving this shift.

One critical observation is that this decline reflects a structural change rather than a temporary fluctuation.

Processes of consolidation, growth, de-listings, and new listings are at play, not unique to the JSE but part of a broader global trend observed in major equity markets worldwide.

Exchanges in the US, Germany, and the UK have also experienced declines in listed companies over similar periods.

Figure 1: Number of listed companies on the JSE 2002 - 2023

Despite the reduction in the number of listed companies, the JSE's overall market capitalization has increased over the same period. This indicates a concentration of value among select firms.

Notably, the proportion of companies with a foreign primary listing on the JSE has risen significantly, from 4.3% to 20.4% of total listings.

This increase in foreign listings underscores the JSE's integration into the global economy, providing domestic investors with enhanced portfolio diversification opportunities.

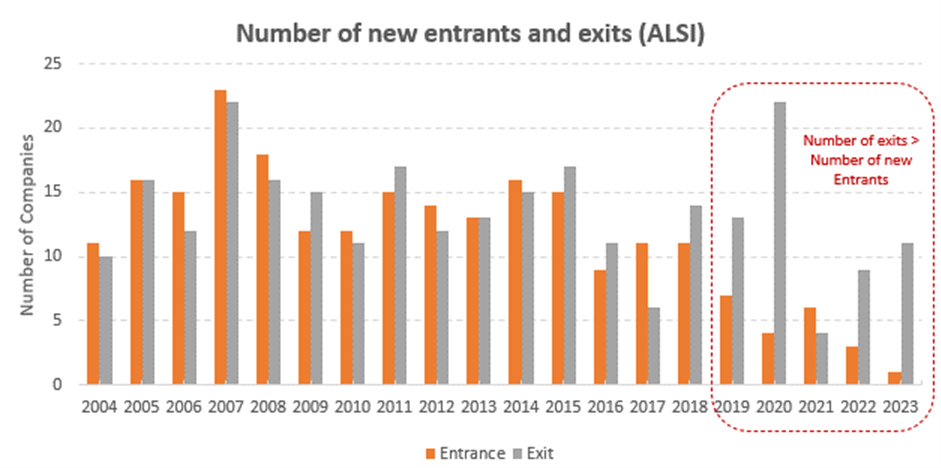

While de-listings are inevitable and serve as a natural part of market dynamics, it's the imbalance between new listings and de-listings that poses the primary concern. Although de-listings have increased in recent years, the reluctance of new companies to enter the market appears to be the main issue.

This imbalance is evident in the steady net decline in the number of shares entering and exiting the FTSE/JSE All Share Index (ALSI) since 2018 (Figure 2). Without a steady stream of new listings, the JSE may face limitations in its ability to adapt to evolving market conditions and provide investors with a diverse set of investment opportunities.

SOURCE: MSCI Barra Portfolio Manager | Momentum Investments Group

SOURCE: MSCI Barra Portfolio Manager | Momentum Investments Group

Figure 2: Annual changes in the number of constituents on the JSE (2004 - 2023)

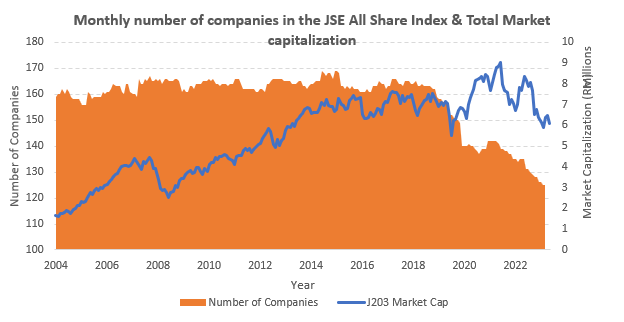

The trend in the number of ALSI constituents over time as observed in Figure 3, reveals a notable 22% decrease from 161 companies to 127 companies over the same period. Concurrently, the market capitalization of the index exhibited an upward trajectory, highlighting a consolidation of market value among fewer entities.

Despite fluctuations in the composition of the index over time, the proportion of total market capitalization lost due to companies exiting remains relatively modest.

This underscores the resilience of the ALSI, indicating its ability to withstand the impact of individual company exits without significantly affecting its overall market value.

SOURCE: MSCI Barra Portfolio Manager | Momentum Investments Group

SOURCE: MSCI Barra Portfolio Manager | Momentum Investments Group

Figure 3: Number of ALSI constituents and their total Market Capitalisation

For asset managers and investors tracking the ALSI, this suggests that while changes in index constituents may occur, the broader market's stability and performance are not as severely affected. For example, in 2023, the JSE saw 23 companies delist while only 11 companies exiting the ALSI, meaning that over 52% of companies delisted are not part of the opportunity set as defined by asset managers.

This discrepancy highlights the selective nature of the opportunity set, with smaller businesses that do not meet the typical size and liquidity requirements of the average asset manager comprising a significant portion of de-listed companies.

The modest decrease in annual market capitalization resulting from exits also suggests that the downward trend primarily stems from exits among smaller to mid-cap companies that fall outside the scope of the opportunity set.

The shrinking investment universe presents both challenges and opportunities. While it limits diversification and investment options, it also concentrates the opportunity set among larger and more established companies, offering the potential for stability and liquidity.

By understanding and addressing the implications of these market trends, asset managers can optimize investment strategies and drive long-term growth in an increasingly competitive global market.

It is crucial to continue to monitor levels of net (new) listings closely. Without a reversal in the current trend, there's a risk of being stuck in a stagnant opportunity set. Potential barriers to new listings may include regulatory hurdles, market volatility, investor sentiment, and competition from other investment avenues.

By identifying and addressing these challenges, the JSE can help create a more conducive environment for companies to go public. This can help revitalize the exchange and ensure its continued relevance in the ever-changing financial landscape.

Recent changes introduced by the JSE to listing requirements in July 2023 may hold the key to driving the necessary change. These developments prompt reflection on the future trajectory of the JSE and its implications for stakeholders.

Disclaimer: The opinions expressed in this article are those of the author. They do not purport to reflect the opinions or views of Group Editors and its publications.

‘We bring you the latest Garden Route, Hessequa, Karoo news’