BUSINESS NEWS - If you are waiting for 1 September to withdraw from your savings pot under South Africa’s new two-pot retirement system, you have to keep in mind that the taxman can take its own share of what you get out, while there will also be other costs such as administration fees.

You could even be restricted from withdrawing at all in some instances.

Vickie Lange, head of best practice at Alexforbes, says the two-pot retirement system will provide a balanced solution by addressing retirement fund members’ needs for longer-term financial security and short-term financial relief.

“It is likely that the two-pot retirement system will improve new members’ retirement outcomes by 2 to 2.5 times compared to those under the current system, given the requirement to preserve their retirement pots fully before retirement.

This change is important because the main reason for members not being able to afford to retire is because only 1 in 10 members preserve their retirement savings when changing jobs.

With the two-pot retirement system, when members unexpectedly need access to cash for financial relief due to emergencies or unplanned expenses, such as medical costs or education fees, they will have the option to make limited cash withdrawals if they have more than R2 000 in their savings pot before retirement without resigning.

Beware of two-pot retirement system’s tax consequences

However, Lange warns that members must be aware of the tax consequences, as these can be significant.

The two-pot retirement system provides tax incentives to keep savings in the retirement fund until the date of retirement and tax disincentives for taking savings out of the retirement fund before retirement.

If you withdraw an amount from the savings pot before retirement, your marginal tax rate will apply to the amount withdrawn.

However, if you wait until retirement to withdraw from the savings pot, the retirement tax table applies and the first R550 000 is taxed at 0% making it tax-free. This is subject to previous amounts withdrawn before September 2024 or from the vested pot.

Lange says for most members it is only worthwhile to withdraw from their savings pot in the event of an emergency and if they do not have access to savings elsewhere. She gives this example of the tax consequences of withdrawing from your savings pot before retirement:

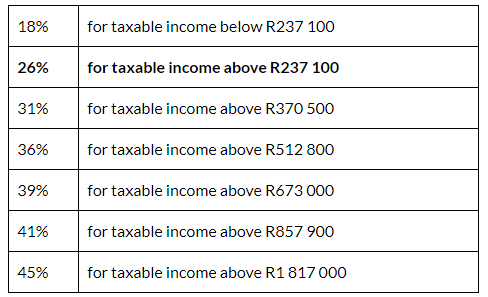

Marginal tax rates for the tax year ending 28 February 2025:

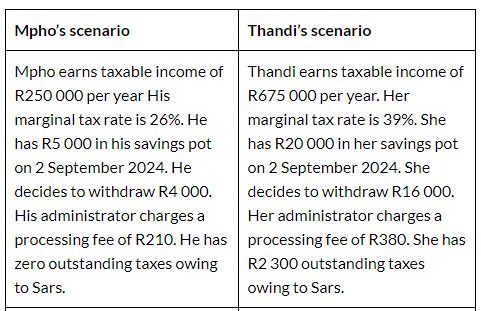

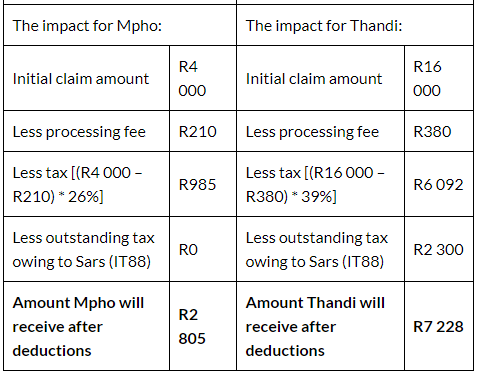

Lange compared these two scenarios to show how it works:

(These amounts are rounded to the closest rand.)

Lange says as these scenarios illustrate, the tax payment can significantly erode the amount paid to members. “Had Mpho and Thandi kept their savings invested in their retirement funds and only withdrawn them at retirement, no tax would have been payable on the withdrawal amounts up to R550 000, assuming they did not take any lump sum withdrawals from their retirement funds before September 2024 or from the vested pot.”

She warns that South Africans must be aware of the tax that is payable before withdrawing from their retirement fund.

Other possible deductions

Lange says you will also have to pay fees related to the two-pot retirement system. These are different depending on the administrator.

“There is no right or wrong way for the fees to apply. What is important is that the fee is fair, transparent and equitable and ensures that quality administration services are provided on a safe and sustainable basis.”

Rather save separately for emergencies

If you really want to be ready for an emergency, Lange suggests that you rather save in a separate emergency fund. “We suggest that members save for emergencies separately instead of relying on their savings pot, which should only be used as a last resort.

“Members are likely to need cash lump sums at retirement to meet their needs, such as moving to a new house, paying off debt or putting money aside for medical costs during retirement. Therefore, it is important not to deplete or use most of your savings pot before retirement.

“You should seek financial advice from an authorised adviser to make sure that your decisions suit your needs. The retirement system is complex and members will be able to make decisions confidently once they understand the consequences of their different options. This ultimately leads to better financial outcomes.”

Article: Caxton publication, The Citizen

‘We bring you the latest Garden Route, Hessequa, Karoo news’