Sponsored Content Video

BUSINESS NEWS - The first quarter of 2024 is well underway, and it is generally expected that 2024 is the year where the recent periods of consistent interest rate hikes by global central banks will shift to interest rate cuts. This could indeed point to more favourable environment for investors in growth assets for 2024. We have experienced markets reflecting a significant rally across asset classes in the past two months, mainly driven by relaxed policies and softer financial conditions.

This follows a rollercoaster ride for investors in the 2023 calendar year, with a positive conclusion in the fourth quarter as inflation eased.

When we look at opportunities in the investment world, we must look at asset classes and what the role of asset allocation is.

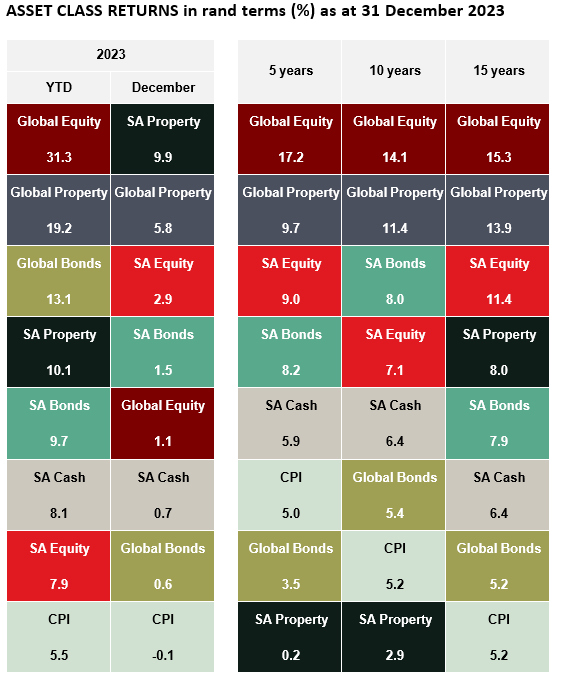

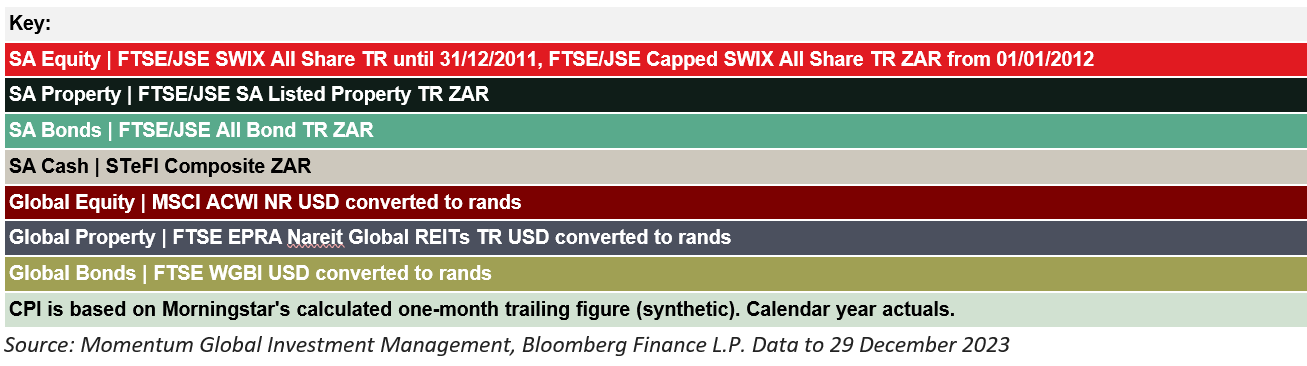

Asset allocation refers to distributing or allocating your capital across multiple asset classes, such as equity, fixed income/bonds, cash, and property. The primary purpose of asset allocation is to reduce the risk associated with your investment whilst also achieving the appropriate returns expected over time. To put expected returns into context, one should consider asset class returns over longer time frames as well.

As can be seen on the graph, equities both globally and domestically are the asset classes that outperformed inflation comfortably over the longer-term although with a certain degree of shorter-term volatility, whereas cash and bonds yield lower but more stable and less volatile returns. Hence, we like to refer to cash and bonds as “nice for sleeping” assets due to less volatility and more stable returns, and equities end properties as “nice for eating” assets with higher inflation-beating returns over the long term.

When we look at clients’ needs and goals and do financial planning accordingly for clients, we must balance the client’s needs and goals with appropriate asset allocation. With 2024 being a local election year and worrying news headlines dominating news flows – we encourage investors as always not to focus or react on short-term events, but to focus on your long-term plans and goals.

Our next step in the planning process for clients is to facilitate a cash flow analysis based on the client’s needs. The purpose of the cash flow analysis is to quantify a client’s future position and the cash flow model will be re-evaluated on an ongoing basis. The cash flow analysis will be another indication of how a client’s portfolio should be structured and managed.

Best Of George Winner

Best Of George Winner

Here are some pointers for being ready for whatever 2024 will bring:

Assess your portfolio.

Speak to your financial adviser and conduct a review of the asset classes where your capital is allocated. Look at the different products where your capital is invested in and assess whether your portfolio is being managed and structured in the best tax efficient way.

Conduct a cash-flow review.

Review your withdrawal rate or contribution rate and review the longer-term implications on your portfolio as a whole.

Make sure you are saving enough to meet your goals.

This goes hand in hand with reviewing your cash flow. Savings refer to your own personal expenses, withdrawal rate on your portfolio as well as contributions. It is therefore applicable whether you are still working and saving for retirement or already retired.

WATCH: Video

“Invest for the long haul. Do not get too greedy and do not get too scared.”

Shelby M.C. Davis

“The best way to measure your investing success is not by whether you're beating the market but by whether you've put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”

Banjamin Graham

Our team assess and plan for clients with a holistic approach to a client’s needs and goals and specialise in investment and financial planning.

Our office details in the Garden Route:

PSG Mossel Bay Diaz PSG George Central

Sioux Building Dynarc House, 2nd Floor

16 Sioux Street 31 Courtenay Street

Mossel Bay George

Mossel Bay Diaz Website George Website

‘We bring you the latest Garden Route, Hessequa, Karoo news’