Sponsored Content Video

BUSINESS NEWS AND VIDEO - Few would argue that 2022 was a difficult year for investors worldwide. We experienced global and local events that had a compelling impact on market returns.

There was literally nowhere to hide in markets in 2022 and to name a few events we saw:

Globally:

- War

- Energy crisis

- Inflation shock

- Aggressive interest rate increases as economies are weakening

- Sharp decline in bond and equity markets

In South Africa:

- Stage 4+ load shedding

- Aggressive interest rate hikes

- Weak economy

- Political crisis (Phala Phala)

- Mass outflows from the SA market

Despite the roller-coaster of worldwide and local events experienced in 2022, you should always have a clear picture and strategy in your investment plan, and appropriately managing your capital and savings throughout different worldwide and local events remains of utmost importance in achieving your investment goals.

“In the midst of every crisis lies great opportunity” - Albert Einstein´

Importance of asset allocation

Asset allocation helps to reduce the risk associated with your investment. It is possible that all your assets may not provide you with similar returns. Some assets that provide market-linked returns may get affected by market volatility.

In addition, asset allocation is important because it has a major impact on whether you will meet your financial goal. If you don't include enough risk assets in your portfolio, your investments may not earn a high enough real returns (after inflation) to meet your goals.

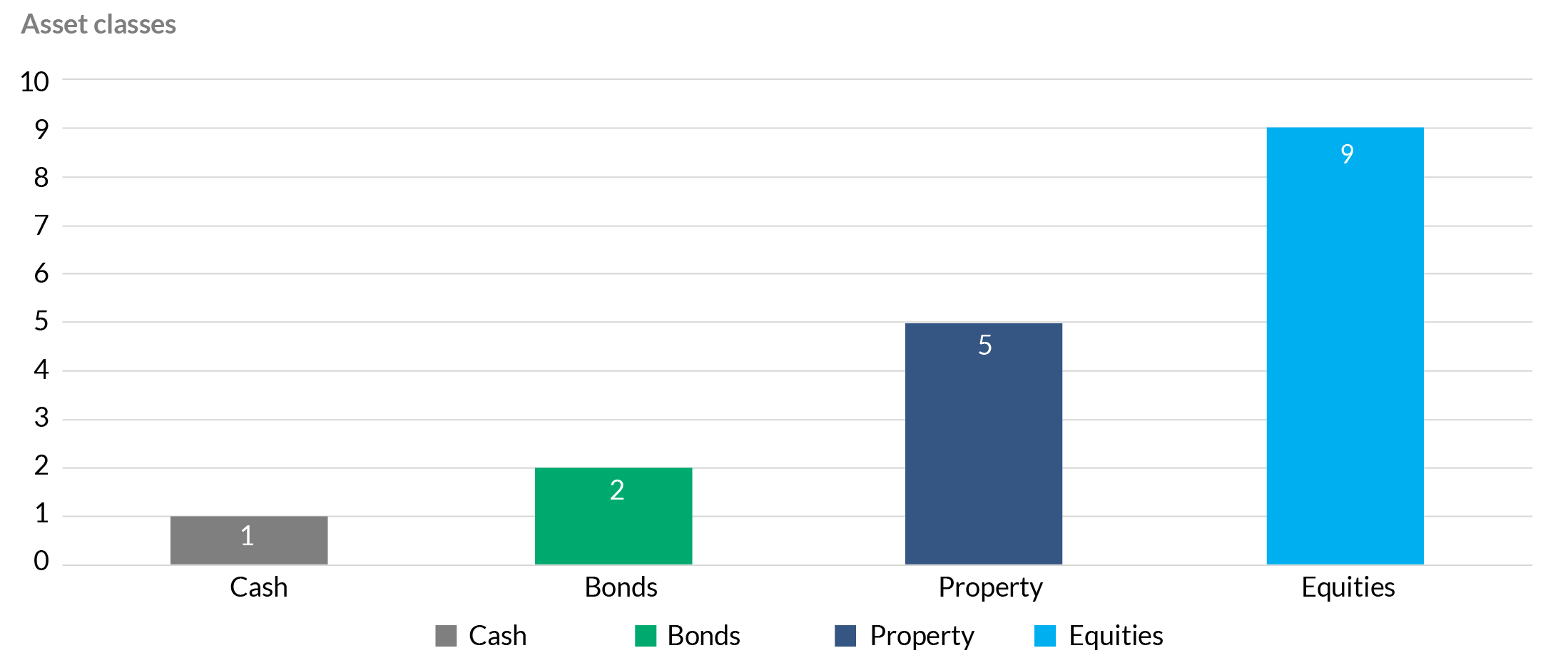

There are four main asset classes with distinctly different long- and short-term return expectations. Research by PSG Wealth showed the following historic real returns from local asset classes before fees and taxes:

- 1. Cash - 1%

- 2. Bonds - 2%

- 3. Shares - 9%

- 4. Property - 5%

Real returns (after deducting 6% inflation, and before fees and taxes)

Source: PSG Wealth research team

Source: PSG Wealth research team

Diversification remains key

Most investment professionals agree that, although it does not guarantee that you will never incur a loss, diversification is the most important component of reaching long-term financial goals while minimising volatility. Having adequate exposure to both local and global markets and other asset classes, such as bonds and cash, remains the key ingredient for achieving investment goals.

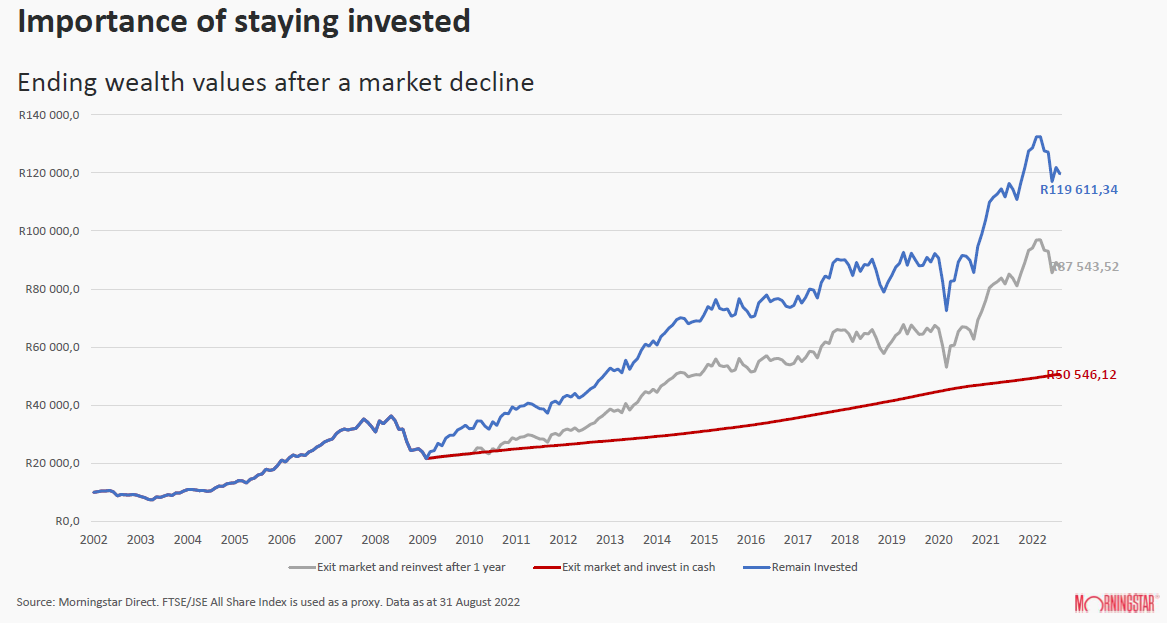

Importance of long-term investing

Investors are more likely to reach their goals if they remain invested and avoid short-term decisions that may take them off course. Ultimately, staying invested for longer periods generally tends to offer a higher return potential, simply because long-term investing increases the chance of positive returns.

At PSG Silver Lakes Outeniqua we specialise in investment planning that helps you in allocating and managing capital to suit your investment goals and needs, regardless of your life stage (savings for retirement, close to retirement or already retired).

Our office details in the Garden Route:

PSG Mossel Bay Diaz

Sioux Building

16 Sioux Street

Mossel Bay

Website Mossel Bay

Facebook Mossel Bay

PSG George Central

Dynarc House, 2nd Floor

31 Courtenay Street

George

Website George

Facebook George

Supplied video:

‘We bring you the latest Garden Route, Hessequa, Karoo news’