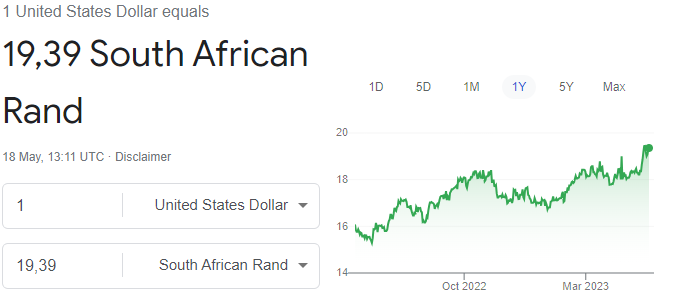

COLUMN - We saw the currency blowout last week following of statements made by the US Ambassador. It still hasn't come back –

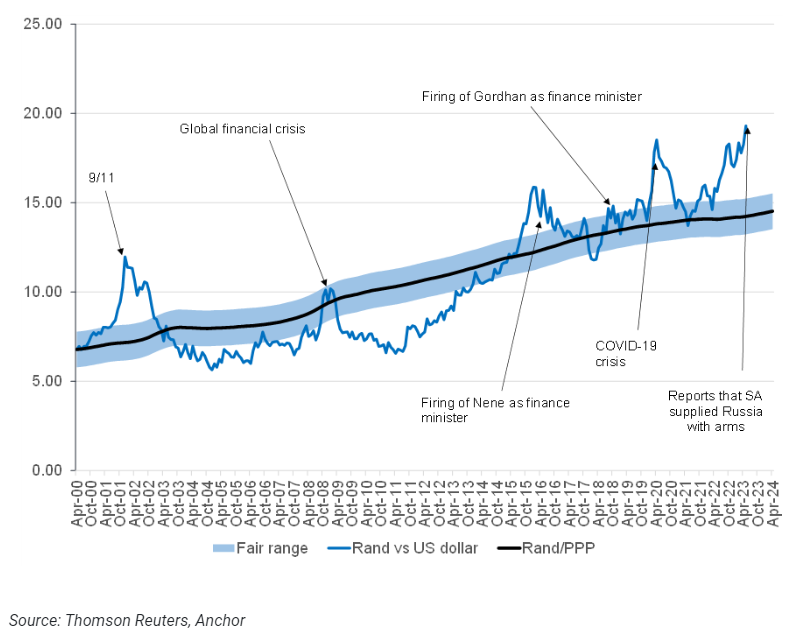

I’ve heard people say the exchange rate is a good proxy for how foreigners perceive risk in our country. I think our bond yields are a better reflection of this.

It's like going to the bank for a loan – the bank looks at your credit score and prices you accordingly. In the same way, SA goes to the international bond market, which then looks at our 'credit score' and prices us accordingly.

Take a look at what the 10-year yield did last week and where it is now. Clearly, what happened last week increased our perceived risk and negatively impacted our ‘credit score’.

(Before the comments of the US Ambassador last week, the yield on our bonds was 9.75%. Today it sits at 11.12%)

An old University friend called me on the day of the spike. He is an investment banker in London specializing in bond trading. It was interesting chatting with him – he has links with the traders at Deutsche Bank and JP Morgan. He said they were jittery on concerns the US would put sanctions on us. No wonder the currency/yields haven't bounced back.

Another point of interest is the upcoming BRICS Summit hosted by SA in August. Putin is expected to join. The international community is going to be watching us closely – expect more volatility to come.

I would point out that the rand has a history of blowing out. If you were here during the Zuma years (and even the Cyril years), seeing the rand blow out is nothing new.

Each blowout has been followed by commentators confidently forecasting the rand going out to R25. But this has never happened. In fact, the data shows the best strategy to follow after a blow-out has been to bring money back into the country. Have a look at the below chart.

Chart: ZAR to USD Source: https://anchorcapital.co.za/macro-research/anchor-rand-view-fixed-income-and-currency-update/

Source: https://anchorcapital.co.za/macro-research/anchor-rand-view-fixed-income-and-currency-update/

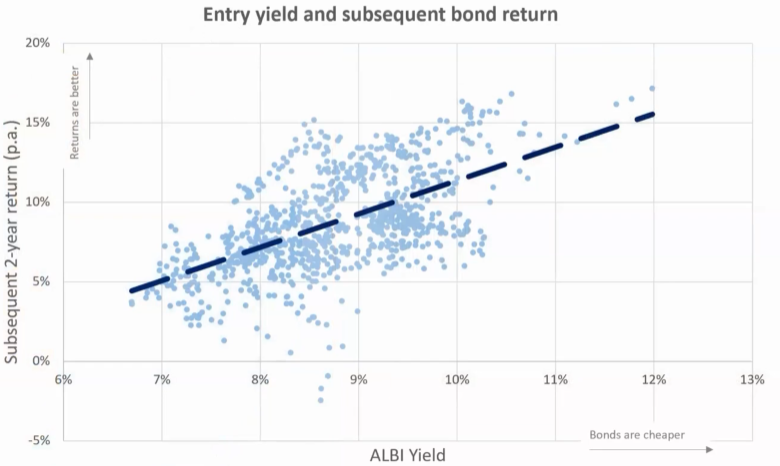

Rather than speculate on what is going to happen in the next 6 months, we should be looking at longer term trends. Are there opportunities here? What does the data say?

The chart below gives a historical view of entry yield and subsequent 2-year returns when investing in SA bonds.

Source: Bloomberg, PortfolioMetrix Presentation

Source: Bloomberg, PortfolioMetrix Presentation

We see a clear trend – higher entry yields, on average, yielded higher 2-year returns. Another observation is that for entry points above 10.5%, the minimum 2-year return was in the region of 10% (remember, our current yield is over 11%).

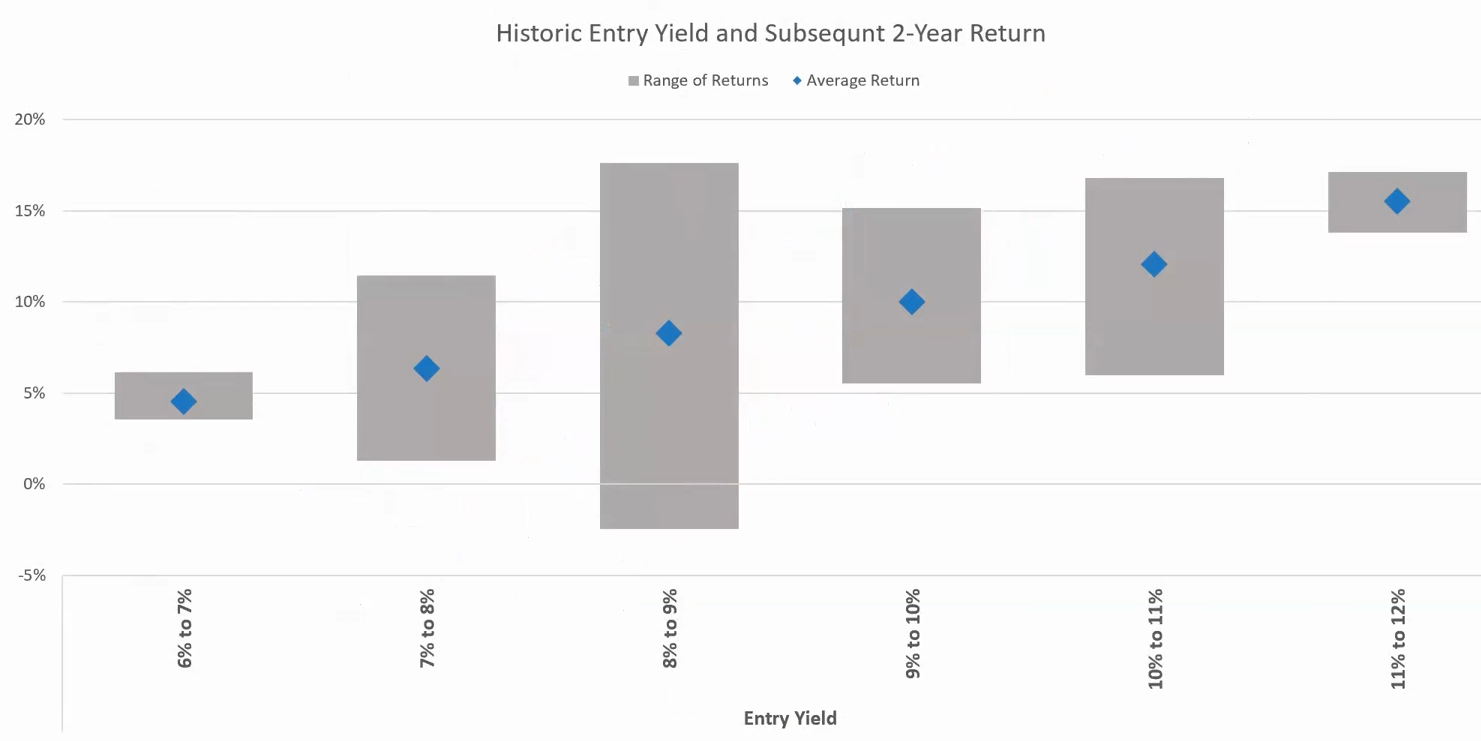

Here’s another view of the same data.

Source: Bloomberg, PortfolioMetrix Presentation

Source: Bloomberg, PortfolioMetrix Presentation

We are currently sitting in the 11.1% entry yield point range. Historically, the subsequent 2-year returns in the bond market for entry yields like this have been between 13% and 17% per annum. Be careful – that’s not my prediction. That’s just what the past data says.

As always, past data does not predict future performance. We can’t know the future. No-one does. It may be different this time.

I hope the above analysis has given you something to think about.

Matthew Matthee

Matthew Matthee

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’