But the cost of this essential commodity is much more than that; it is made up of many different costs that, together, constitute what is commonly referred to as the petrol price. Let us explain what it involves.

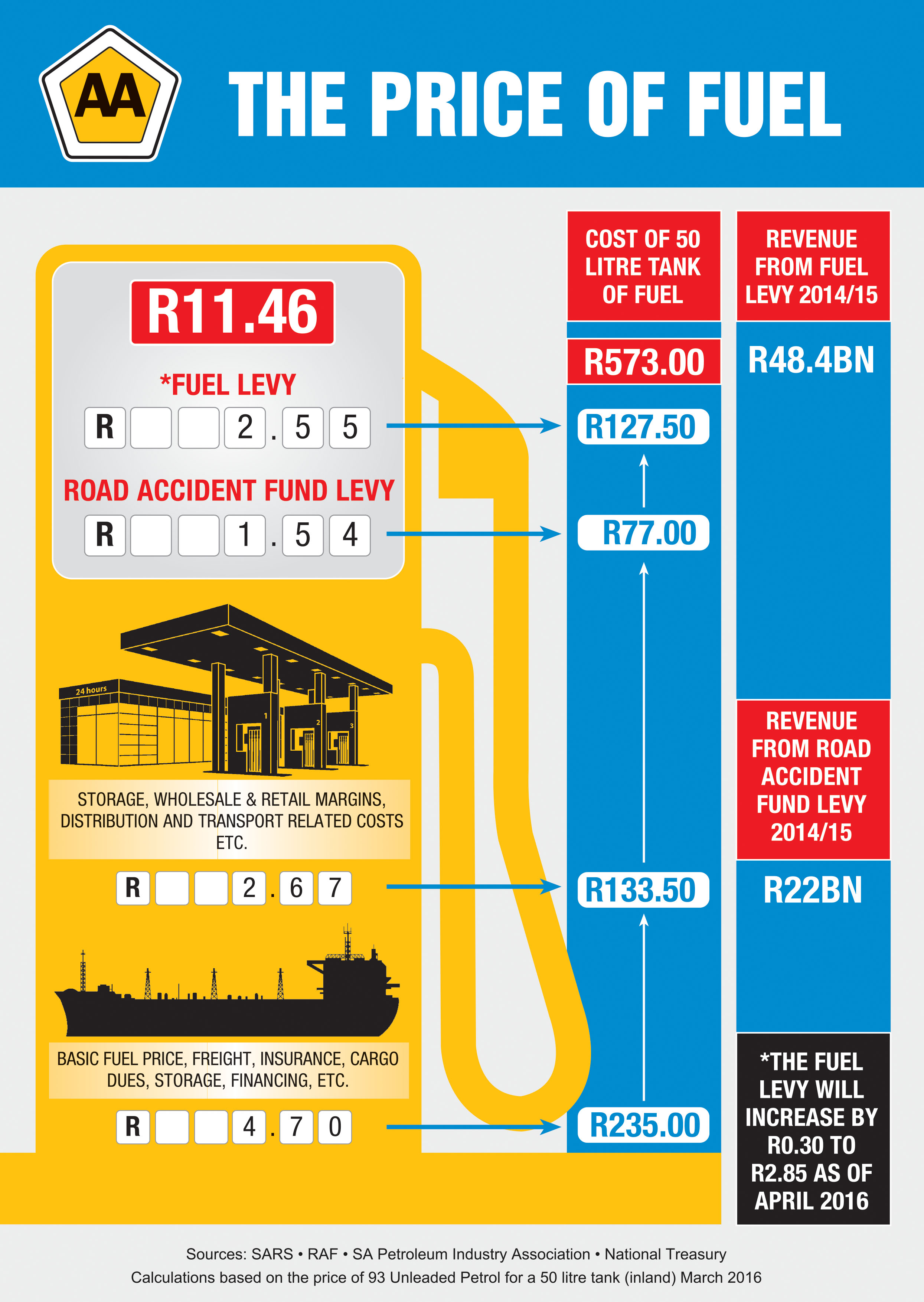

In April the cost of a litre of fuel will be impacted by a 30 cents a litre increase in the Fuel Levy, announced by Finance Minister Pravin Gordhan during his budget speech in February. This will move the Fuel Levy – a tax collected on every litre of fuel sold - from R2.55 to R2.85 a litre. The money collected through the Fuel Levy is administered by the National Treasury, and is treated as a general tax, not, as many people assume, road-related expenses.

In March 2016, these costs totalled R6.76 (for inland users) per litre for 93 unleaded petrol. Of this, R2.55 was allocated to the Fuel Levy, and R1.54 was allocated to the RAF Levy. The Fuel Levy goes directly to the National Treasury, while the RAF Levy goes to the RAF, and is used to care for victims of car crashes.

This means that for every litre of petrol costing R11.46, R4.09 (or almost 35 percent) is allocated to different government levies. In April this will increase to R4.39 per litre.

Using this formula, filling a 50 litre tank with 93 unleaded petrol inland, will cost you R573. Of this, R127.50 goes directly to the Fuel Levy with a further R77 going to the RAF Levy, giving a combined total of R204.50.

If the price of petrol remains unchanged at the end of April, and only the increase in the Fuel Levy is recorded, the cost of filling a 50 litre tank will increase to R588. Of this, the Fuel Levy will comprise of R142.50, and RAF Levy will remain unchanged at R77, for a combined total of R219.50 generated from the two levies.

What are your thoughts on the matter? Do you think that it is fair for the government to squeeze every last cent out of the public or do you feel that it is an effective way for the government to generate an income to better the lives of others?

Check Nam Auto Cars to find a car in Namibia