BUSINESS OPINION - Sometimes, the financial world makes things far more complicated than it needs to be.

A recent example I came across involved a highly complex investment strategy with layers of charges and multiple moving parts. Lots of sophistication. High upfront fees. Plenty of market timing.

The underlying idea was that a large, important portfolio demands a complex solution — something more “robust” than simplicity. A premium solution.

It reminded me of Harvard’s endowment — a $50 billion fund with a famously poor track record. Despite hiring expensive, top-tier managers and allocating to hedge funds, private equity, and structured products, the returns were consistently underwhelming.

I understand the logic: Harvard is a sophisticated institution, so naturally, it needed a sophisticated (and expensive) solution.

In hindsight, simply buying the S&P 500 would have delivered far better returns.

The balance sheet I was looking at wasn’t in crisis — just like Harvard’s endowment. Even in the worst market conditions, it would have continued to meet its liabilities and grow.

When you visit a doctor, they don’t reach for the scalpel unless it’s necessary. If you’re healthy — and it’s only anxiety about what could go wrong that’s giving you a headache — perhaps all you need is a Disprin.

What’s often overlooked is that even the Disprin — the small tablet that dissolves quickly and does the job — is the product of extraordinary complexity. Behind its simplicity lies decades of pharmaceutical science: intricate chemical formulation, testing, and precision. It looks simple — but it’s anything but.

That’s how a good portfolio framework should work. It might seem straightforward on the outside — something we can understand and stick with — but it’s built on layers of rigorous research, statistical modelling, and behavioural insight. Simplicity at the front. Sophistication at the back.

We use Jaco van Tonder’s framework for our income portfolios. Jaco is an actuary at Ninety One, an asset manager overseeing more than R3 trillion. He’s built one of the simplest tools I’ve seen — yet behind it lies a mountain of modelling and risk analysis.

But that tool is remarkably effective. And if we know how to use it, we can answer important, real-world questions like:

- Can I take a sabbatical?

- What are the implications if I want to buy a business?

- How can I enjoy my money now without jeopardising my future?

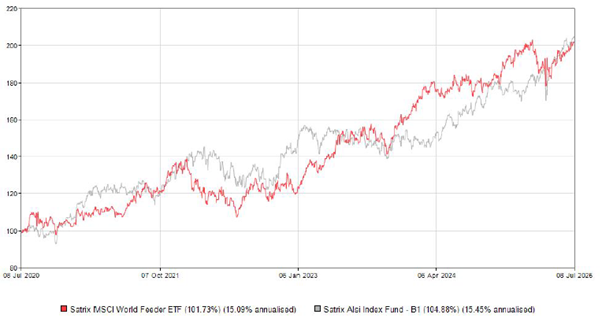

Here is an example of a simple solution - Over the past five years, simply owning the local and global markets would’ve given you a 15% annualised return — with no overlays, timing calls, or complexity. Just plain exposure. That’s hard to beat.

Chart: 5 year performance of JSE (local market) and MSCI World (offshore markets)

Chart: 5 year performance of JSE (local market) and MSCI World (offshore markets)

Simplicity in investing isn’t about taking shortcuts. It’s about avoiding unnecessary complexity and reducing the likelihood of costly mistakes. It’s about knowing when the Disprin will do the job — and not reaching for the scalpel unless absolutely necessary.

As Charlie Munger put it:

“I can’t think of a single example in my whole life where keeping it simple worked against us. We’ve made mistakes, but they weren’t because we kept it simple.”

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’