BUSINESS NEWS - Geopolitical events always feel like the start of something bigger. And sometimes, they are.

The recent fighting between Israel and Iran is still unfolding, and it’s still too early to know how serious it might become.

There are worries about oil prices, radioactive fallout, and broader instability across the Middle East.

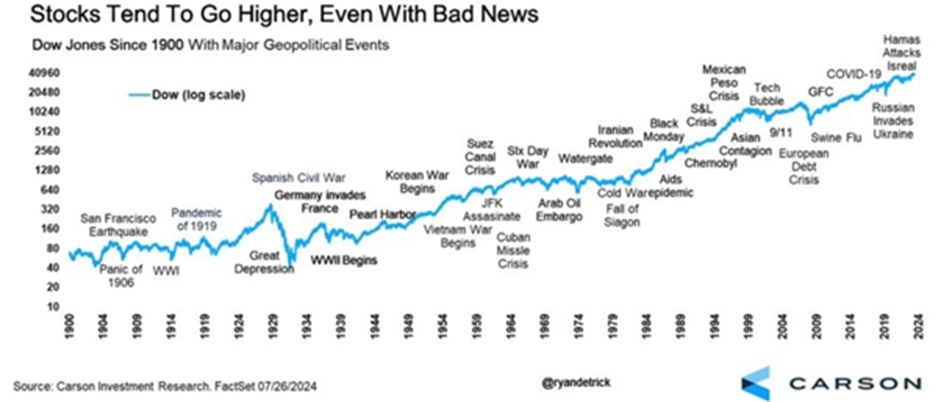

Historically, markets have often shrugged off geopolitical shocks.

There’s a long list of events — wars, bombings, political uprisings — that caused short-term sell-offs but were quickly forgotten in the charts a few years later.

Investors who stayed the course typically did well.

READ MORE: The cost of financial neglect: Lessons from a Hermes heir

But not every event is forgettable.

The COVID-19 outbreak triggered one of the sharpest global market crashes in history — and an unprecedented policy response that reshaped interest rates, inflation, and asset prices for years.

The 2008 financial crisis started with subprime mortgages in the U.S., but quickly spiraled into a global recession and years of low growth, low rates, and market instability.

But this kind of uncertainty is exactly why we have a plan — diversified portfolios, long-term thinking, and quality holdings. We’re not ignoring the risks. We just know that reacting emotionally to every headline usually does more harm than good.

If this conflict fizzles out and markets keep running, we’ve got healthy exposure to growth assets to move portfolios in the right direction.

If it doesn’t, and stock markets take a tumble, we have enough of a buffer to ride it out.

Stick to the process. If you have a plan, then regardless of how this pans out — you’ll be okay.

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’