Sponsored Content

BUSINESS NEWS - Since US President Donald Trump’s declaration of ‘Liberation Day’ earlier in 2025, it would be fair to say that market volatility has been on extremely high levels thus far throughout the year. No matter how experienced you are in investing, volatility can be quite daunting, however it is and will remain a natural part of investing.

What causes market volatility?

Market movements are driven by what experts across the world think will happen next. These analysts estimate the impact on markets, and we see market fluctuations resulting from these estimates and decisions that get made.

Increased volatility often happens during periods of economic stress. It can be caused by economic or policy factors, including interest rate changes and inflation. Political instability can also cause market volatility, as can global events such as a pandemic or war.

Ways to navigate periods of volatility

As an investor, you can’t avoid market volatility. But keeping these 3 principles in mind could make the ride feel less bumpy.

Keep calm and see the bigger picture

Short-term volatility doesn’t always affect the long-term growth of your investment. So, it will always help to focus on your long-term goals during volatile periods. Market recovery could be quick, but can also sometimes take longer, so you should really focus on the longer time horizon of your investment.

For further information contact: Adriaan de Waal: +27 (72) 591 4557 | adriaan.dewaal@psg.co.za or Janko Sieberhagen: +27 (79) 731 1388 | janko.sieberhagen@psg.co.za

It does currently feel as if uncertainty is heightened, with stock markets in the USA falling by more than 10% during the first 4 months in 2025, caused by various factors of which potential global trade wars seem to

be the biggest driver. But it is at times like these that we must remind ourselves that no one can predict the future and that it is more important for us to focus on the things we can control. Things in the past have also been uncertain — and yet somehow, we got through those tough times, and will again.

When we see the change and seemingly increased levels of uncertainty that have happened across the world in the last couple of years, it’s not surprising that markets have indeed jumped around.

Staying invested

When markets are at their most volatile periods, it’s tempting to sell growth assets to avoid further losses and move your funds to more stable and less volatile assets such as cash and bonds. But always remember that any financial loss only takes effect if you sell your investments.

Stay diversified to help weather the storm

Always remember that not all types of investments are affected the same during periods of volatility.

By combining different types of investments, you could potentially lower your overall risk of loss. That’s because a lower return in one type of asset, like equities, may typically be compensated by a gain in another type, such as bonds. This is called diversification.

Investing and volatility will always go hand in hand. But keeping these principles in mind could help to lessen the impact when the markets drop.

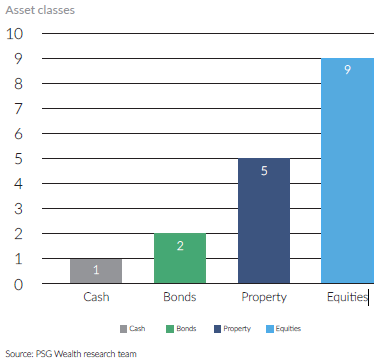

Keep in mind that different asset classes have their different roles in a well-constructed investment portfolio. Each of these plays a unique role in your portfolio, providing the potential for growth, income, relative stability or inflation protection. By adjusting how much you own of each asset class, you can adjust the risk/reward potential in your portfolio to create a mix that suits your goals and time horizon.

Real returns (after deducting 6% inflation, and before fees and taxes)

While severe downturns naturally evoke fears of permanent damage, history shows that markets eventually rebound, often robustly. This doesn’t imply that disruption requires no response, but rather that investors should avoid making fear-driven decisions.

The current risk of a potential trade war raises concerns that significant market disruption, muted global growth and elevated inflation may still lie ahead. We are likely still in for a bumpy ride over the next couple of months.“Eighty percent of the things people fear, never happen”

— Dr Joe Buscalia

Overestimating the probability or the extent of losses during extreme market turbulence can lead you astray. To obtain a more realistic view, rather get a better perspective by looking at how your investments have responded to similar events over time.

As markets continue to be rattled by tariff disputes and compounded by local political uncertainty, you may be confronted with the temptation to switch into lower-risk assets, or to disinvest. If you find yourself on the verge of making a panicked decision to safeguard your investment, reflect on whether your personal circumstances, investment goals or time horizon has changed. If not, it may be better not to react. History continues to reinforce the lesson that long-term value is created by investing into uncertainty and remaining invested through it.

“Successful investing takes time, discipline, and patience”

— Warren Buffet

Our office details in the Garden Route:

PSG Mossel Bay Diaz | Sioux Building, 16 Sioux Street, Mossel Bay www.psg.co.za/mosselbaydiaz

PSG George Central | Dynarc House, 2nd Floor, 31 Courtenay Street, George https://advisers.psg.co.za/branch-office/outeniqua

‘We bring you the latest Garden Route, Hessequa, Karoo news’