BUSINESS NEWS - You know the economy is tough when Woolworths sees its clothing and beauty sales fall and management still pats itself on the back for a job well done.

“It’s a really good set of results,” says Woolies CEO Ian Moir. “We took market share in tough conditions.”

This was despite its fashion, beauty and home division seeing profit fall 1.1% to R1.68 billion for the year to end-June. The drop is however something of a turnaround, as this division plunged 21% to R1.7 billion in the corresponding prior period.

The recovery is even more remarkable when measured against its performance in the first half of its 2019 financial year, which saw this division’s sales fall 11.8% for the period.

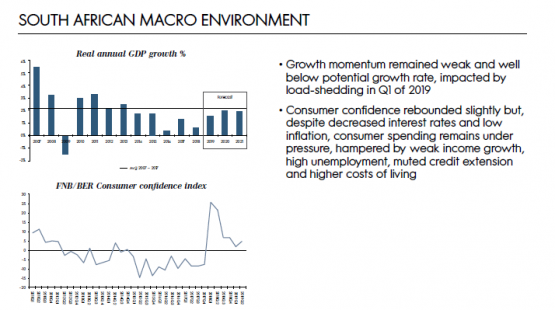

Even so, Moir does not see the economy coming to the group’s aid anytime soon, with sluggish trading conditions expected to persist in South Africa and Australia, its other key market. Uncertainty about the government’s plan to boost the economy in SA and the slowing housing market in Australia has dampened consumers’ willingness to spend.

Read: David Jones continues to weigh down Woolworths

Woolies is not the only local retailer that has struggled to find traction in a difficult economy. Big box retailer Massmart and Africa’s largest supermarket chain, Shoprite, have also found the going tough. Massmart saw trading profit collapse from R664.4 million to R318.9 million for the half year to end-June.

There is a similar story at Shoprite, where trading profit for its South Africa operations fell 9.1% to R6.55 billion for the year to end-June.

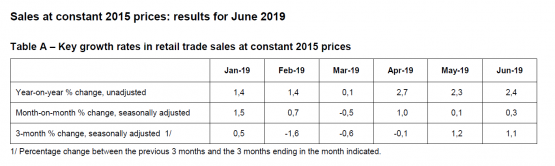

The difficulty for retailers can be seen in Statistics SA’s latest retail sales numbers, showing just a 2.4% rise year on year for the month of June.

Aside from softening consumer confidence, local retailers didn’t do themselves any favours; several of them made strategic mistakes that have compounded their problems.

David Jones

The difficulty at its David Jones chain in Australia, for example, saw Woolworths reduce the value of this asset by Au$437.4 million (R4.5 billion) this year, following it writing off Au$712.5 million (R6 927 million) in the previous year.

Woolworths bought David Jones for R21.5 billion in 2014. At the time, the acquisition was part of a broader plan to turn Woolies into a global retail player.

Instead, the problems in Australia led to the South African retailer incurring a loss in 2018.

The lengthy redevelopment of David Jones’s flagship Elizabeth Street store in Sydney has also not helped. The redevelopment started in the second half of 2017 and is expected to be completed by March 2020.

The renovation is part of several chain-wide initiatives aimed at improving David Jones’s performance; others include the implementation of new merchandising, finance and online systems, and the relocation of its head office from Sydney to Melbourne.

Moir says most of these initiatives are complete and the group is now well placed to profit from them.

Even so, getting to this point has not been easy. In February, David Jones CEO David Thomas resigned with immediate effect for “personal reasons”. Moir, who is based in Australia, has since taken over the running of the chain.

The problems in Australia were further compounded by the sudden resignations of two of its Australian-based board members, Patrick Allaway and Gail Kelly, days later in February.

The board has since been boosted with the addition of former Clicks CEO David Kneale, who joined as an independent non-executive director in March.

Struggling down under

Tough trading conditions and the lengthy redevelopment of its flagship store saw David Jones’s sales collapse from R660 million to R378 million.

David Jones is not the only problem Woolies has had to contend with. Its other Australian chain, Country Road, also faced an uphill battle – with profit falling 1.6% to R1 billion, and sales for the year growing just 0.5%.

It was not all bad news in Australia, however. Country Road’s online sales rose 12.9%, and now represent 20.3% of total sales for the chain. There was a similar story at David Jones, where online sales were up 46.8% and contributed 7.7% to its total sales.

Grocery growth

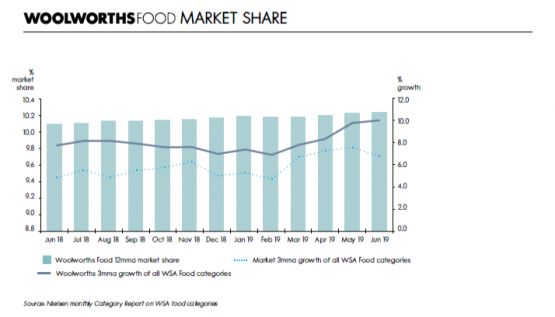

Although a tough year for Woolies, its local food operation has grown in strength – with operating profit up 5.4% to R2.28 billion. The group expects food to continue to grow in terms of volume, and to take market share.

The food division accounts for the bulk of the group’s profit, followed by fashion, beauty and home at R1.68 billion, Country Road at R1 billion and David Jones at R378 billion.