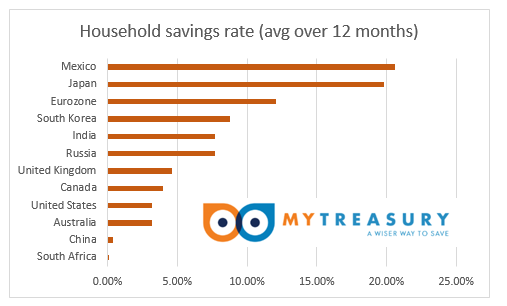

BUSINESS NEWS - According to analysis done by savings fintech start-up MyTreasury.co.za, South African’s household savings rate comes last when ranked against the G20 countries.

This is distressing news during savings month as it means that too many South Africans are living in debt or eating into their capital.

These finding are consistent with the worrying picture painted by Old Mutual Savings Monitor: among urban working households, an alarming 40% of respondents said they have no form of formal retirement savings at all. Thirty-two percent of respondents said they would rely on government and 38% their children to support them in retirement. The situation is likely much worse among the unemployed population.

Source: MyTreasury

Source: MyTreasury

In addition, many of those South Africans who do manage to squirrel away some money aren’t saving wisely. While 16 million do have savings accounts, they are emptier than they should be and, according to the latest SA Reserve Bank statistics, about 40% of this money sits in accounts that offer very low interest rates, if any interest at all.

A person who has savings could be earning as much as 10% on their money each year, and growing their wealth faster, just by switching to higher-interest paying accounts.

Since the launch of MyTreasury.co.za in late 2016, the independent personal finance comparison website has allowed more than 250 000 South Africans to compare their saving options online – helping them to identify the best interest- rate options based on their personal situations and requirements.

The easy-to-use service is free and gives users suitable alternatives once they have answered a few simple questions. It searches 600 different rates at 10 financial institutions to find the best options.

Users can select amounts from R1 000 to R50 million, and specify how soon they might need access to their money (ranging from one day to five years) – and the options are constantly expanding.

During national savings month many organisations are coming out with useful tips and campaigns to get South Africans excited about saving.

Recommendations about how to save range from lifestyle changes – such as hunting for bargains, limiting luxury spending and committing to put away a fixed amount of money every month – to more long-term strategies like setting financial goals, consolidating debt and paying off loans early.