COLUMN - We have elections coming up in South Africa and in the US next year. We also have the continued electricity crisis in South Africa at the forefront of our myriad other problems. The Ukraine and Russia war seems like it will never end, and the China recovery is not going as well as it should.

But this is nothing new.

There have always been and always will be uncertainties in the world and reasons to feel despondent. But when we look back to where we were 18 months ago (at the start of 2022 when inflation began its rapid rise), we seem infinitely better off:

It looks like a soft landing (no recession) for the US and Europe.

Inflation has peaked and continues to decline.

The US consumer has shown continued resilience despite the aggressive interest rate hikes.

Global growth has been stronger than expected.

So, while uncertainties remain, we must remember we are far better off today than we were 18 months ago. There has been a huge amount of progress.

And how have markets fared?

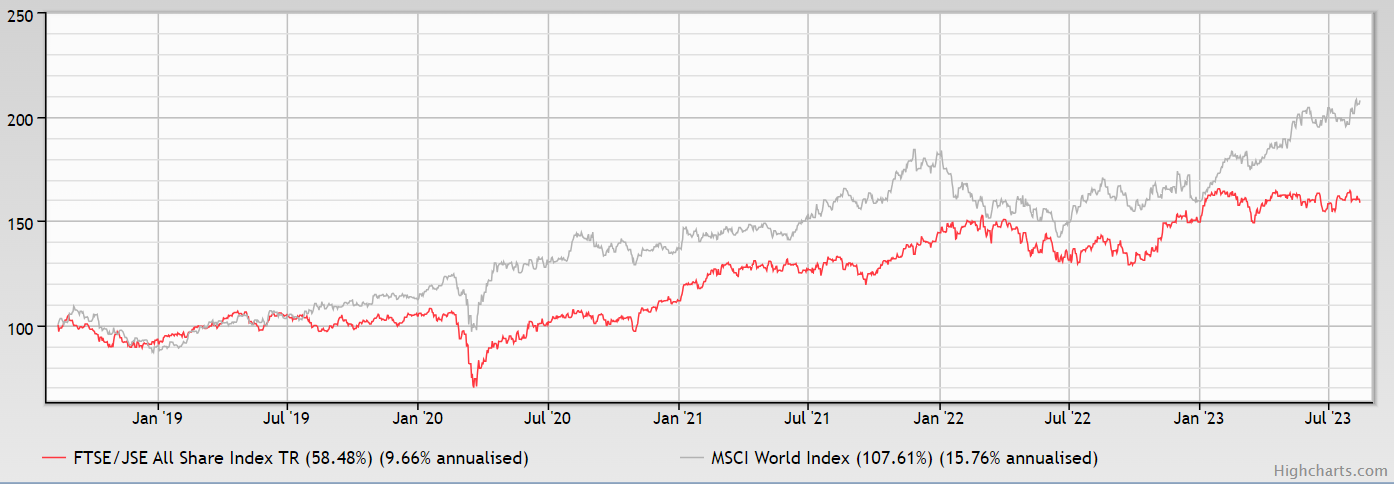

The chart below shows the JSE All Share index (our stock market) and the MSCI World index (international stock market that is made up of 70% America) performance in rands over these past 12 months.

Chart: JSE and MSCI World performance over 12 months to today

The JSE gave you 12.13% and the MSCI World gave you 26.45%. Not bad. Not what we had expected 12 months ago, right?

Looking back over the past 3 years, the JSE gave you 14.37% per annum and the MSCI World index gave you 13.35%. Those are great returns and pretty much in line with long-term averages.

Chart: JSE and MSCI World performance over 3 years

Going back 5 years and before we had even heard of Covid (these numbers include a market crash), the JSE gave you 9.66% per annum and the MSCI World gave you 15.76% per annum. Again, those are great numbers.

Chart: JSE and MSCI World performance over 5 years

The one pattern all these charts have in common, though, is that the returns did not come in a straight line. This is the nature of the market and why getting your asset allocation correct from the start is so important. Having a financial plan solves this.

If 5 years ago someone had told you we were going to go through a significant market crash, a global pandemic, a war in Europe and one of the highest rates of inflation in the past 100 years, you never would have invested.

You would have kept your money in the bank. That would have made 100% sense. And you would have earned about 6% in interest income that would be taxed at your marginal tax rate.

Knowing what we know now, keeping money in the bank would have been a terrible investment decision.

It’s true that there is still a lot of uncertainty in the world today about our future (especially South Africa). But remember, it has always been this way, and it will likely be this way for many years to come.

The best thing to do is not get caught up in the present. Focus on the end result. Think long term. Build a strategy and stick to it and let markets do what they do best – go up.

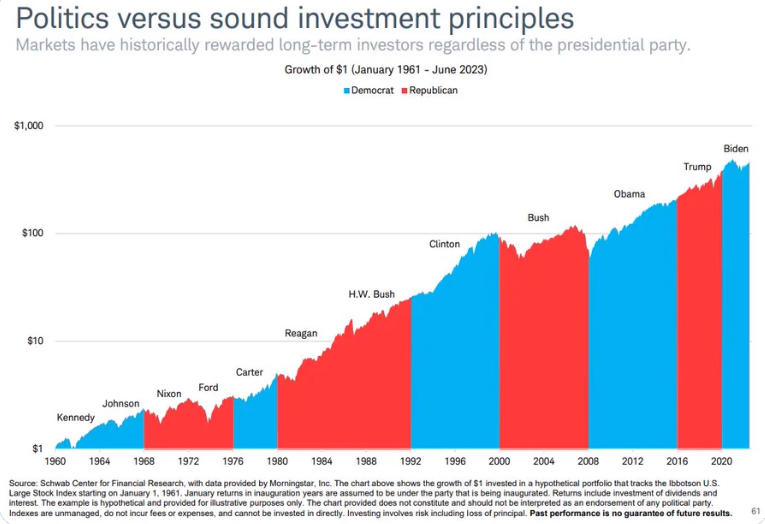

I’ll leave you with a chart of the S&P500 through the lens of the different US presidents. Not much difference between blue and red really, the market level goes upwards and to the right.

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’