BUSINESS NEWS - Growth in sales at Spur Corporation’s existing Panarottis restaurants has declined for the first time in more than five years. In its sales update for the year to June 30, chief executive Pierre van Tonder says “Panarottis has been impacted by fierce competition in the pizza market and a shift in promotional strategy”.

Sales at existing Panarottis and (upmarket brand) Casa Bella sites declined by 0.6% in the year, while total sales were up 4.2%. Together, the two brands account for the group’s second largest division by store count and sales (‘pizza and pasta’).

In 2017, the pizza and pasta unit reported restaurant sales (i.e. through tills) of R760.6 million (behemoth Spur, by comparison, reported restaurant turnover of R4.5 billion).

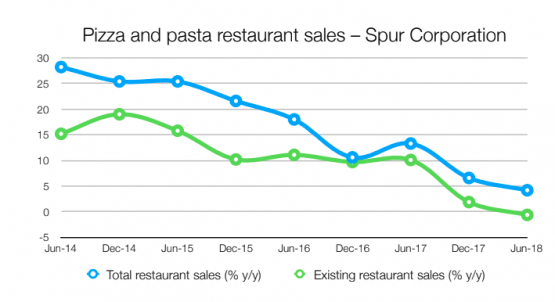

The negative trend over the past number of years has been clear. Sales growth in total restaurant sales in the division has been affected by slowing new store openings. Panarottis store numbers have been flat for much of the past two years (81 in June 2016, 80 in June 2017 and 83 in December 2017). The only real growth in footprint has come from Casa Bella, which is at seven stores from a standing start just more than two years ago.

Source: Company sales updates

Panarottis used to own Tuesday nights in the category, with its popular buy one, get one free promotion, which ended earlier this year. Panarottis shifted its promotional strategy to “reduce reliance on discounting” following a similar shift at Spur, which saw it terminate its hugely popular buy one, get one free Monday night burger special last year (read: No more free lunch at Spur). At Spur, “a combination of judicious promotion coupled with product improvement has improved franchisee margins and ensured that our franchise financial model remains sustainable”.

Discounting was tempered at Panarottis between January and June this year, with the two-for-one Tuesday special replaced by an all-day promotional price for classic pizzas and pastas.

As Panarottis moderated its discounting, the category has become fiercely contested with practically all chains offering some sort of special offer early in the week. In May, Col’Cacchio introduced a “Twosday” special with two-for-the-price-of-one pizzas and pastas during winter. Its store count of roughly 40 is about half of that of Panarottis. Smaller Piza e Vino, with about a dozen outlets, has also launched a dinner-for-two special on Mondays and Tuesdays.

Add to this the takeaway and delivery space (think Debonairs, Domino’s, Pizza Hut and the long list of independents), and it’s easy to see why the category is as fiercely competitive as it is. To counter the home delivery threat, Panarottis in July introduced a “call and collect” special with two pastas for R149.90. Most of its franchisees are listed on Mr D and Uber Eats to further compete in this space.

That the ceasing of heavy discounting has had such a significant impact on sales growth is not a surprise. Promotions were, to some extent, propping up sales. Middle income consumers remain under huge pressure and continue to flock to ‘value’.

For Spur Corporation, negative same-store growth at Panarottis is problematic as it was one of two engines of growth for the group. Taken as a whole, turnovers in the pizza and pasta division are about a third larger than the other engine of growth: RocoMamas.

But that unit is growing fast. As at the end of June 2017, restaurant turnover at its then 50 South African stores totalled R477.7 million. And with a growth rate of 31.5% in the year to end June 2018, the figure will climb to nearly R630 million. It’s not hard to see RocoMamas being larger than the pizza and pasta franchise by 2020, especially with decent double-digit increases, coupled with tepid sales growth at Panarottis.